Brexit's Effect on New York's Ascent as a Main Monetary Center

A new review by Duff and Phelps shows that New York has surpassed London as the main worldwide monetary focus, basically because of the repercussions of Brexit. The yearly Worldwide Administrative Standpoint study included reactions from 180 chiefs across different areas, for example, resource the executives, multifaceted investments, confidential value, banking, and business.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

LATEST POSTS

- 1

6 Travel Services for Colorful Get-aways: Pick Your Fantasy Escape

6 Travel Services for Colorful Get-aways: Pick Your Fantasy Escape - 2

Car Investigation: A Survey of \Past the Outside\ Car

Car Investigation: A Survey of \Past the Outside\ Car - 3

Reporter's Notebook: The Post embeds with foreign armies visiting the IDF

Reporter's Notebook: The Post embeds with foreign armies visiting the IDF - 4

The most effective method to Shake Hands Expertly: A Bit by bit Guide

The most effective method to Shake Hands Expertly: A Bit by bit Guide - 5

Nations for Youngsters to Visit

Nations for Youngsters to Visit

Share this article

Significant Elements to Consider Prior to Applying for a Mastercard: 6 Vital Contemplations

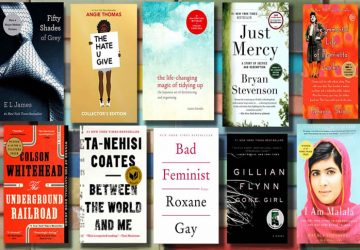

Significant Elements to Consider Prior to Applying for a Mastercard: 6 Vital Contemplations The Most Compelling Books of the 10 years

The Most Compelling Books of the 10 years Sound Propensities: 20 Methods for helping Your Insusceptible Framework

Sound Propensities: 20 Methods for helping Your Insusceptible Framework Ariana Grande to host 'Saturday Night Live' Christmas show with Cher as musical guest, returning after nearly 40 years

Ariana Grande to host 'Saturday Night Live' Christmas show with Cher as musical guest, returning after nearly 40 years People Are Sharing The One Picture They Can't See Without Laughing, And It's The Comedy Spiral You Need Today

People Are Sharing The One Picture They Can't See Without Laughing, And It's The Comedy Spiral You Need Today NASA's SPHEREx telescope completes its 1st cosmic map of the entire sky and it's stunning!

NASA's SPHEREx telescope completes its 1st cosmic map of the entire sky and it's stunning! 1st human missions to Mars should hunt for signs of life, report says

1st human missions to Mars should hunt for signs of life, report says Jamaica reports deadly leptospirosis outbreak after Hurricane Melissa

Jamaica reports deadly leptospirosis outbreak after Hurricane Melissa The Incomparable Advanced cameras: Which One Will Win?

The Incomparable Advanced cameras: Which One Will Win?